More Time, More Freedom: How Flexible Payments Are Changing the Game

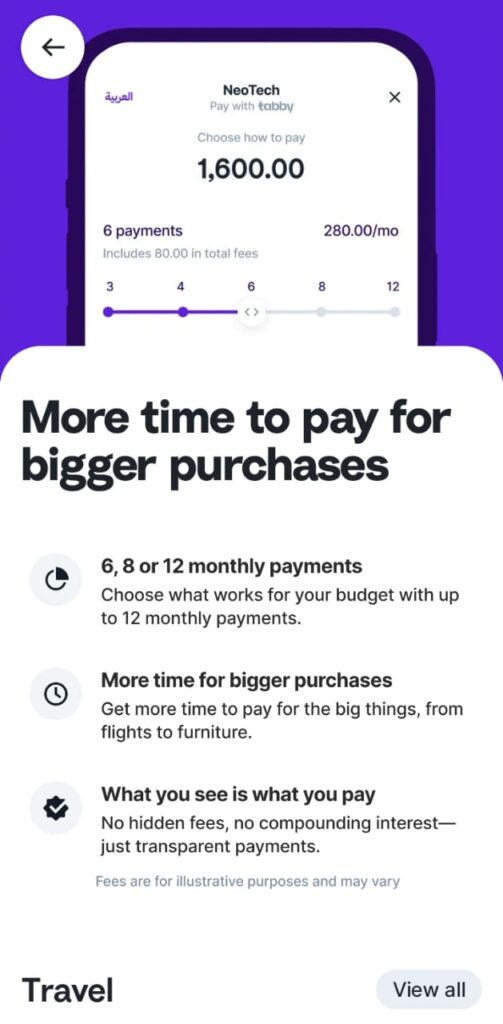

Imagine this: You finally find that dream gadget, that perfect flight deal, or the sleek piece of furniture you’ve been eyeing. But there’s a catch—it’s a bit out of budget this month. What if you could break it down into manageable payments, without hidden traps or compounding interest? Enter flexible payment solutions, like those offered by NeoTech through Tabby.

The Power of Choice

Traditionally, big purchases came with two options: pay upfront or use a credit card (and risk high-interest rates). Now, the game is changing. With plans ranging from 6, 8, or even 12 months, consumers can tailor their payments to match their budget. Instead of a financial burden, purchases become a series of predictable, transparent installments.

More Time for What Matters

Why does this matter? Flexibility isn’t just about money it’s about lifestyle. Whether you’re booking flights, upgrading your home, or investing in tech, spreading out payments means you don’t have to compromise. You get what you need now, without disrupting your cash flow.

No Hidden Fees, No Surprises

One of the biggest concerns with financing options is the fine print. Compounded interest, late fees, unexpected charges it’s enough to make anyone hesitate. The beauty of these new models is transparency: what you see is what you pay. That means no hidden fees, no surprises—just a simple, structured plan.

The Future of Payments

Payment flexibility is more than convenience it’s empowerment. It gives people control over their finances while keeping their purchasing power intact. As more businesses adopt this model, the days of rigid, stressful payments might just be behind us.

So next time you’re eyeing that must-have purchase, remember: you might have more time to pay than you think.