At the first ever Fluidity Conference, hosted at Al Habtoor Hotels and curated by visionary entrepreneur Jason Njoku, a new kind of conversation sparked one that didn’t just connect Africa and the Gulf, but rewired the flow of ideas between two of the world’s fastest growing tech eco-systems.. More than a summit, Fluidity set the tone for a new axis of innovation with Dubai as the launchpad, Africa as the opportunity engine, and Saudi Arabia rising as the region’s funding superpower.

From Scrappy to Scalable: Dubai’s Startup Evolution

Ekta Bhojwani, Founder & CEO of eecrow, reflected on the once-fragile state of the Gulf’s startup scene:

“Dubai used to be a tough place to build no VCs, no culture of failure, limited founder support. Now? It’s where ecosystems come to scale.”

Her story emphasized how Dubai matured from an experimental hub to a global platform for emerging market founders. The city’s operational support, regulatory openness, and investor access are now drawing talent and capital from both West Africa and the wider MENA region.

Saudi Arabia: Capital, Confidence, and Global Attention

Walid Faza, General Partner at Novo Capital, brought the spotlight to Saudi Arabia’s dynamic and well-funded startup ecosystem:

“Riyadh is becoming a force. The capital here is not just abundant—it’s intelligent, long-term, and founder-aligned. It’s no longer about joining the game. Saudi is setting the terms.”

Faza detailed landmark moments that validated the MENA ecosystem:

- Uber x Careem: A $3.1B exit that gave the region credibility.

- Amazon x Souq: Proof that international giants see MENA as a serious play.

- Tabby: The Saudi-born fintech unicorn scaling aggressively across the region.

“These deals didn’t just put MENA on the map—they told the world that exits and unicorns are not reserved for San Francisco or Berlin,” Faza said.

Olumide Soyombo: Betting on Integrity and Execution

Olumide Soyombo, Founder of Voltron Capital, delivered one of the event’s most unapologetically founder-focused takes:

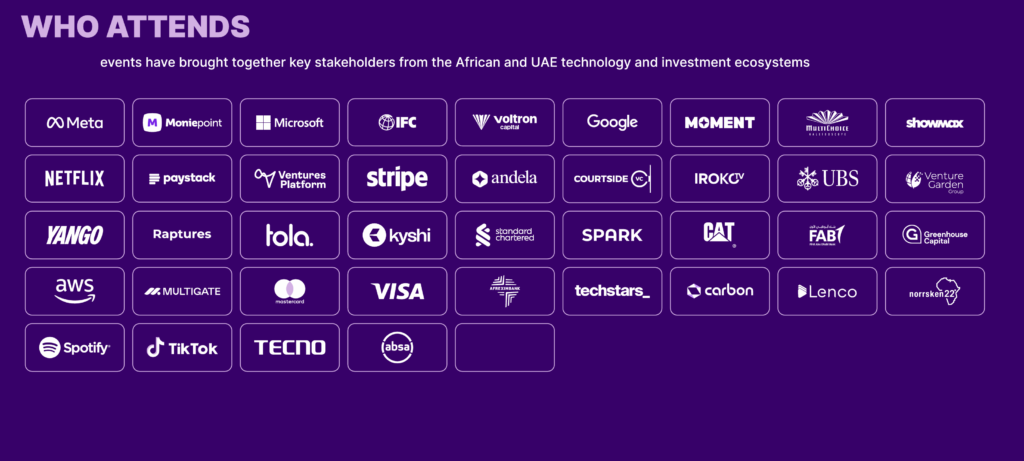

“We don’t work with F-head founders. That’s a hard rule. You can have a great idea, but if you’re not accountable, you’re not scalable.”Soyombo outlined his VC philosophy grounded in trust, execution, and partnership. His firm, Voltron Capital, has backed over 67 African startups—including game-changing names like Moniepoint, one of the continent’s fastest-scaling fintech